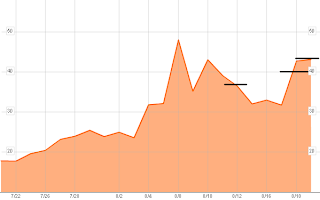

DIG Entry and Exit Levels

There is still an opportunity in oil, I will be looking to repeat this trade on Monday when I am not facing into the head wind of a weekend risk unwind, if anything Monday brings the possibility of a tail wind through new risk coming in.

Risk Unwind - Traders closing positions so that they have no exposure to the market over the weekend when markets are closed and there is no opportunity to cover open positions if the market moves against them.

New Risk Coming In - The market is open for trading, oil appears oversold, traders that have unwound risk into the weekend will be opening new positions i.e. adding risk, this should provide a lift to oil.

Looking back over the logic of this trade I am quietly kicking myself for not holding the position over the weekend. A good set up for the weekend would have been to close the position in DIG and reinvest the capital in USO. This would have reduced my risk by half and still allowed me to participate in any rally in the futures markets before the US Cash market opens.

And Now -

The Pit Bull Trade

So far so good. The rope is holding at a VIX of 43. I have three positions against VIX, one is a core position which I intend to hold for a month or more while VIX returns towards its long term mean value of around 20. The other two are short term trades. The plan is to take advantage of any short term blips in the VIX by buying successive positions in XIV (inverse VIX).

I have marked the approximate VIX levels I have positions against on the chart below.

The strategy for this trade is to add positions as VIX Spikes, as the spike fades so each position will come into the money.

Note: its important to acknowledge that under exceptional circumstances VIX Could double from its current level, therefore I will not be adding new capital (value at risk) unless VIX breaches 60 and then 80. These are extreme levels which have previously collapsed very quickly leading to quick profits. It is only these extreme edge cases that would justify the addition of new capital to this current trade. In the short term I will be looking to reduce my value at risk by taking profits, preserving capital to take advantage of any new spikes.

No comments:

Post a Comment