The short answer is no.

DIG is a leveraged ETF which attempts to return two times the daily return of oil. I have just taken a position in DIG at 38.75 and will be intending to exit this position in a few hours time. There are well documented issues with holding any of the leveraged ETFs over time, the chief problem is that the leverage compounds losses. There is also a built in value decay with any of the ETFs that are based on rolling derivative contracts. But to take advantage of a short term bounce DIG will do just fine.

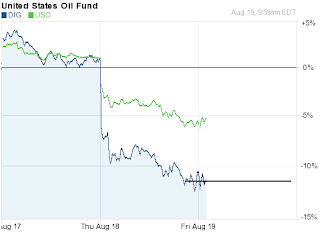

I have marked my entry point on the chart, USO has 5% to go to get back to Wednesdays close, DIG has 10%. On the basis that we didn't all just park our cars and start walking to work, I will be taking my chances on DIG for the next few hours.

No comments:

Post a Comment