Understanding the performance of many ETFs and ETNs is like peeling onions, there can be layer after layer of complexity, often more than enough to make your eyes water.

The XIV ETN is a defining example of this complexity. Quoting from the prospectus, first we have the full product name -

'XIV: VelocityShares Daily Inverse VIX Short-Term ETN'

Then we have this sentence from the first paragraph which summarises the aim of the product -

'The return on the ETNs is linked to the inverse of the daily performance of the S&P 500 VIX Short-Term Futures™ Index ER less the investor fee'

So what exactly is XIV and how can it be expected to behave ?

The Exchange Traded Note (ETN) XIV is widely positioned in the media as a way to short the VIX Index. This is an incorrect positioning of XIV. The issuer uses deliberate language to outline the product, this language will have been carefully reviewed by the issuers legal department.

The summary makes reference to several key points -

1) 'Less the investor fee' - there is an annual fee built into this product which is 1.35%, this fee is applied daily according to a calculation also outlined in the prospectus.

2) 'VIX' - VIX is an index, its basically a value calculated and published by Standard and Poors. It isn't something real, you can't buy a VIX.

3) 'VIX Short Term Futures' - While you can't buy a VIX as it isn't something physical, you can buy a futures contract for VIX. A futures contract is essentially an agreement between two parties that one will pay the other the difference between the value of VIX on a future date and the current value of the VIX. The party buying the contract will benefit if the value of VIX rises, the party selling the contract will benefit if VIX Falls.

4) 'Daily Performance' - this is a key piece of wording, all derivatives based ETFs and ETNs are now at pains to point out that they are 'Linked to Daily Returns' this is due to a wide range of factors which cause these products to significantly under perform over an extended period. Put simply most of them are mathematically guaranteed to lose money if held over an extended period. Hence the 'linked to' and 'daily performance'.

5) 'Inverse' - this means that the product is intended to return the opposite percentage of the 'VIX Short Term Futures' on a daily basis minus fees. While these points are common to many ETFs and similar wording will be found in many ETF prospectus, my interest is in the ability of XIV to provide short (inverse) exposure to the VIX index which is the context in which XIV is most often positioned.

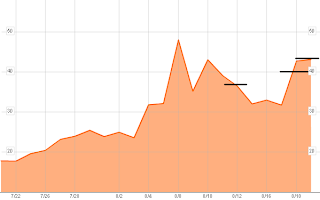

The following chart shows the price action in VIX over the past 5 days

I have marked a line on the chart to indicate that over the past 3 days, VIX held at a level which was 30% higher than it closed on August 17th. Within the highlighted period there have been intraday moves of -15% at the open on Friday 19th and -17% at the open on Monday 22nd.

If XIV represented a suitable product for gaining short exposure to VIX, we should have expected corresponding spikes in the value of XIV which could have been sold for a quick profit.

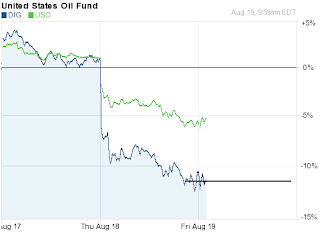

The XIV Summary explicitly states that XIV provides returns inverse the 'S&P 500 VIX Short-Term Futures™ Index ER'. This index is not the VIX index itself but a basket of futures contracts to buy the VIX over the present month and next month. The following chart shows the performance of SPVXSP the ticker symbol for the 'S&P 500 VIXShort-Term Futures™ Index ER' index.

There are three observations when comparing the two charts

1) SPVXSP - Does not jump 30% and then stay there but rather gaps an initial 15% and then continues to rise at a gradual rate through the next two days

2) The intraday spikes in SPVXSP are much smaller, around 5-10% against 15-18% in VIX

3) Although VIX appears to be fading on Monday 22nd closing around 8% down on the preceding close, SPVXSP continues to rise closing around 10% up on the Friday close. As a final observation at the present time, VIx is down intraday to a level only 20% above its close on August 17th, whereas SPVXSP is still more than 30% above its value on the 17th.

All of the observations are explained by the difference between the spot VIX index and the SPVXSP Index which is composed of a basket of futures contracts on the VIX Index. Futures contracts generally respond less than the immediate or 'spot' prices that they follow. The assumption is that whatever short term disturbances are impacting the market, these will pass in time so the future price of VIX tends to discount these effects.

This is enough to explain the smaller jumps in price, but there is another more powerful effect at work which is not immediately obvious from the charts, its also the most important factor from an investment perspective.

The steady upward path on the SPVXSP is in part due to 'roll'. The SPVXSP index is calculated based on rolling futures contracts forward, that means that everyday, a portion of the futures contracts which are nearest expiry are sold and the proceeds reinvested in contracts further out in the future. The rapid spike in the spot price of VIX this week has caused a market condition know as 'backwardation' where the spot price is higher than the futures prices.

As I type the VIX Prices are

| SPOT | 38.2 |

| VIX September | 34.95 |

| VIX December | 32.10 |

| VIX January | 30.47 |

This is a very positive condition for SPVXSP, when the contracts are rolled forwards, ie. sold at today's price 38.2 and reinvested in the next months contracts at 34.95, SPVXSP increases in size as its possible to buy more contracts using the proceeds of todays higher price to buy next months lower priced contracts.

While VIX remains elevated, the number of futures contracts that are purchase each day is elevated, and also the next month and later contracts will creep up in price towards the spot price. There is a dual effect of increasing the number of contracts held and an increasing value of the contracts held.

As good as this is for SPVXSP, it is equally bad for XIV which provides inverse performance to SPVXSP.

While backwardation often occurs in VIX Futures, it is an exception from the norm and generally passes quickly. Under normal circumstances where VIX Futures are a at a premium to spot, SPVXSP will suffer roll decay through selling expiring contracts at prices lower than the replacement contracts can be purchased leading to a daily reduction in the total number of contracts held within the fund.

For the past few days, my trades in XIV have been on the wrong side of this, steadily losing value as SPVXSP benefits from the temporary backwardation in VIX Futures.

Although VIX Has fallen over 10% today, spot VIX is still at a premium over current month and next month VIX Futures, this will provide some support to SPVXSP which is only down 3.3%.

For my positions in XIV to really pay off I would need spot VIX to fall below the current month and next month futures prices.

I will be selling my positions into the current risk on rally ahead of Fridays Jackson Hole meeting. I may then reenter the positions depending on the Jackson Hole outcome.